What Matters More for Emerging Markets Investors: Economic Growth or EPS Growth? (2022)

Jason Hsu, Jay Ritter, Phillip Wool, Harry Zhao

The Journal of Portfolio Management Emerging Markets 2022, 48 (8), URL/PDF

What’s Growth Got to Do With It? Equity Returns and Economic Growth (2015)

Joachim Klement

The Journal of Investing Summer 2015, 24(2), URL

Is Economic Growth Good for Investors? (2012)

Jay Ritter

Journal of Applied Corporate Finance, 24(3), URL

Economic growth and equity returns (2005)

Jay Ritter

Pacific-Basin Finance Journal, 13(5), URL

This week’s AGNOSTIC Paper is one from the myth-busting category and examines the relation between countries’ GDP growth and stock market returns. The idea and analyses are admittedly not new and the paper is basically an update of one of the authors previous work. Nonetheless, I think the question is very interesting and still very relevant for regional asset allocation.

Everything that follows is only my summary of the original paper. So unless indicated otherwise, all tables and charts belong to the authors of the paper and I am just quoting them. The authors deserve full credit for creating this material, so please always cite the original source.

Setup and Idea

Go Where the Growth Is – I bet everyone working in investment management knows this sentence in some form. No wonder, it just seems intuitive that higher GDP growth of (emerging) countries and regions should translate into higher stock returns, right? I also fell prey to this shortcut when I began investing some years ago. Based on the Go Where the Growth Is idea and the historical outperformance of emerging markets, I overweighted an MSCI Emerging Markets ETF in my personal investments back in 2018. If you look at the performance since then, you know how it turned out…1Thankfully, I adjusted my position after learning at some point that this conclusion is flawed.

As this week‘s authors show, the idea of Go Where the Growth Is is way too simple and neglects a lot of basic theoretical logic. In fact, the second result below illustrates that we don‘t even need much empirical analyses to debunk this myth. But as usual, let’s look at data and methodology first.

Data and Methodology

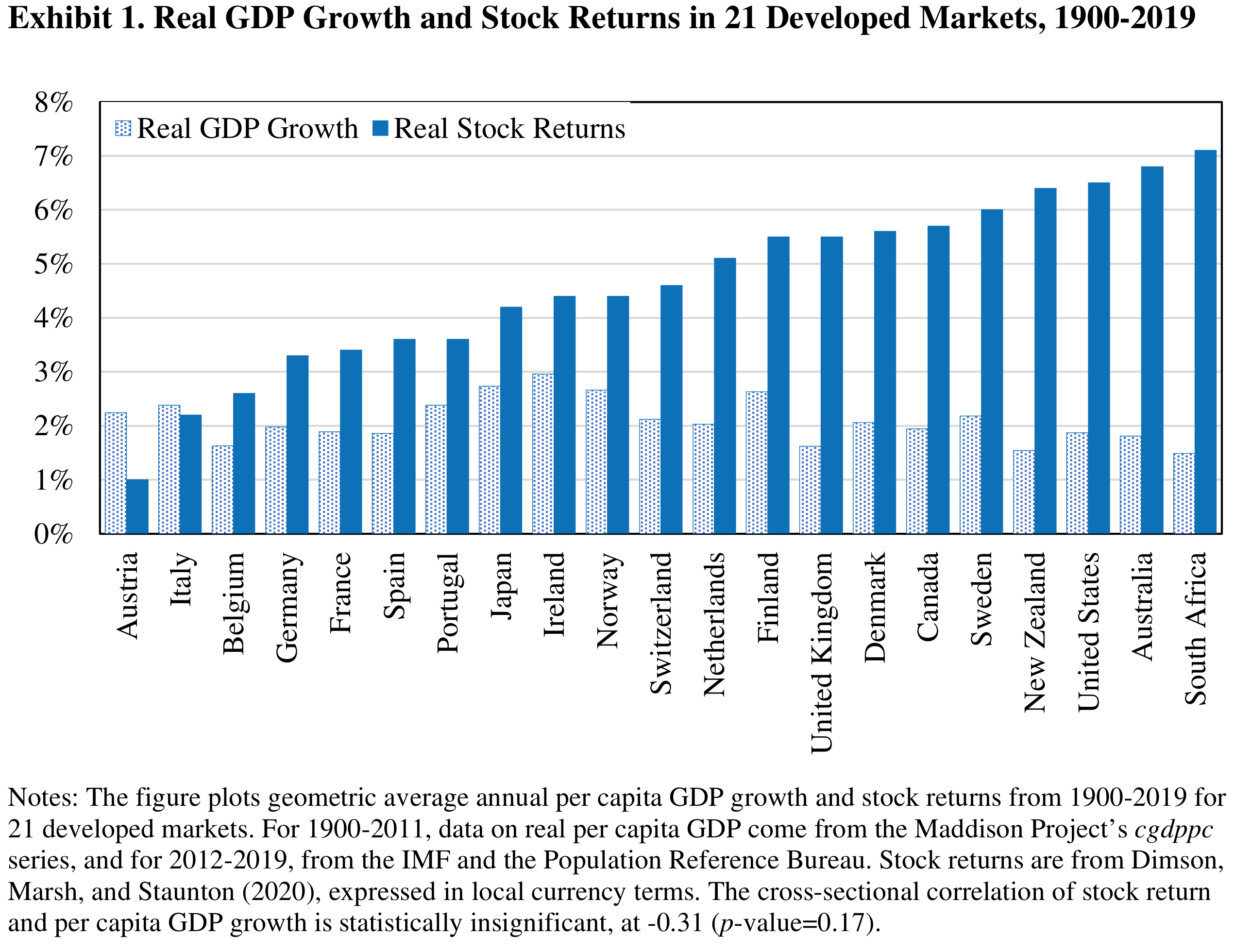

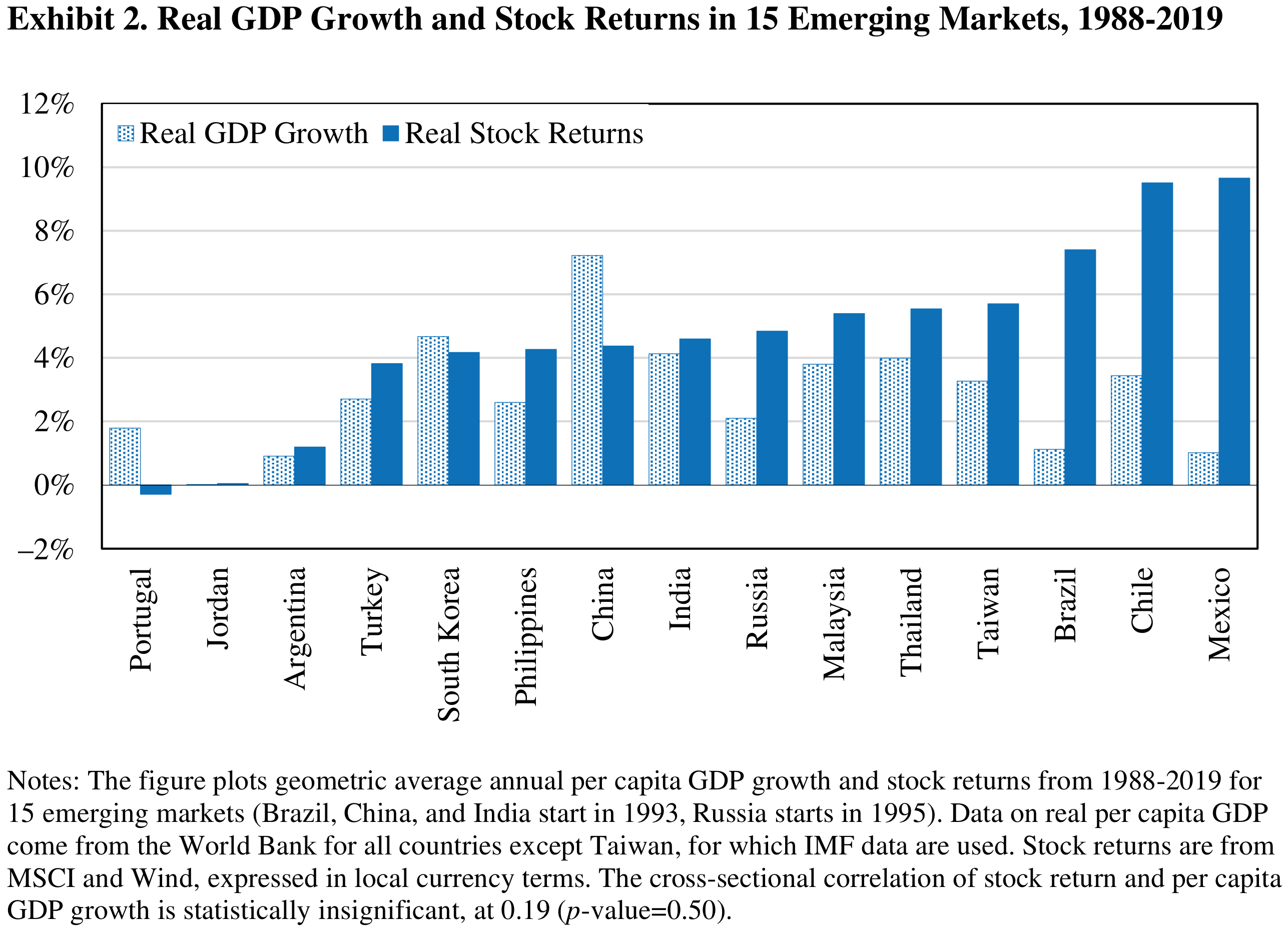

The authors collect long-term historical data on real stock returns and GDP per capita from various sources.2The captions of the following charts provide the specific data sources for each analysis. They obtain data on 21 developed markets between 1900 and 2019, and 15 emerging markets between 1988 and 2019. As the data comes from trustworthy former research and well-known institutions like the IMF or World Bank, I believe data quality shouldn’t be an issue. Also note that the paper is basically an update of former work by Jay Ritter, one of the co-authors, which has been published in peer-reviewed journals.

After collecting the data, the methodology is very straight forward. The authors simply calculate correlation coefficients and the corresponding test statistics for the cross-section of countries‘ stock returns and various economic time series. This is as simple as it can get, but in this case sufficient to debunk the myth of Go Where the Growth Is.

Important Results and Takeaways

GDP growth and stock returns are not correlated over the long-term

Let’s start with the key result straight at the beginning. Historically, there is no statistically significant correlation between real stock returns and real GDP per capita growth. Period. This means that just because a country outgrows other regions in terms of GDP doesn‘t mean that its stock market will also outperform. The authors illustrate this result for their sample of developed and emerging markets in the following two charts.

The empirical facts are pretty clear and just looking at the charts already suggests what the formal statistics confirm. The correlation between real stock returns and real GDP per capita growth across countries stands at -0.31 for developed, and 0.19 for emerging markets. Both are statistically not distinguishable from zero with p-values of 0.17 and 0.50, respectively.

What does this mean for investors? Well, there is no empirical evidence for the idea that the stock markets of faster-growing economies should outperform those of their slower-growing counterparts. So even if you are right and correctly identify a fast-growing country ex-ante, this doesn’t necessarily translate into equity outperformance. In fact, it is essentially random from a statistical perspective.

I believe those are important insights for all investors who overweight emerging markets solely based on the expectation of higher GDP growth in those economies. Even if you are right with your growth forecast (which is already difficult), your stock market investments can still disappoint. The underperformance of emerging markets and in particular China over the last years are perfect examples for that.

Theoretically, the missing relation is not surprising

While the empirical results may seem surprising at first glance, they are actually not. The authors provide a very simple framework to think about the issue. You can decompose any stock return into three components: dividends per share growth (DPS), earnings per share (EPS) growth, and the change in the P/E ratio attached to those EPS.3The authors stress that earnings per share instead of aggregate earnings matter for stock investors. For example, aggregate earnings could rise via IPOs even in a period of declining profitability. The GDP growth of the underlying country doesn’t show up in this equation. A stock is nothing but a claim on a firm’s cash flows, so those should ultimately matter for equity returns over the long term.

You can of course argue that higher GDP growth should ultimately translate into higher EPS and cash flows, but there are various caveats. For example, the composition of the business sector naturally differs between countries. If most of the earnings from strong GDP growth are generated by unlisted private companies, the stock market could still underperform.

The authors also explain that the key beneficiaries of higher GDP growth are typically consumers instead of businesses. In a market economy, companies compete for consumers’ money and thereby foster innovations that ultimately fuel GDP growth. As the empirical evidence shows, it is very difficult for companies to remain profitable and successful over long horizons and many of them die rather quickly. Most of the benefits from economic growth therefore go to consumers instead of companies and their shareholders. Capitalism is actually quite brutal for those on the playing field…

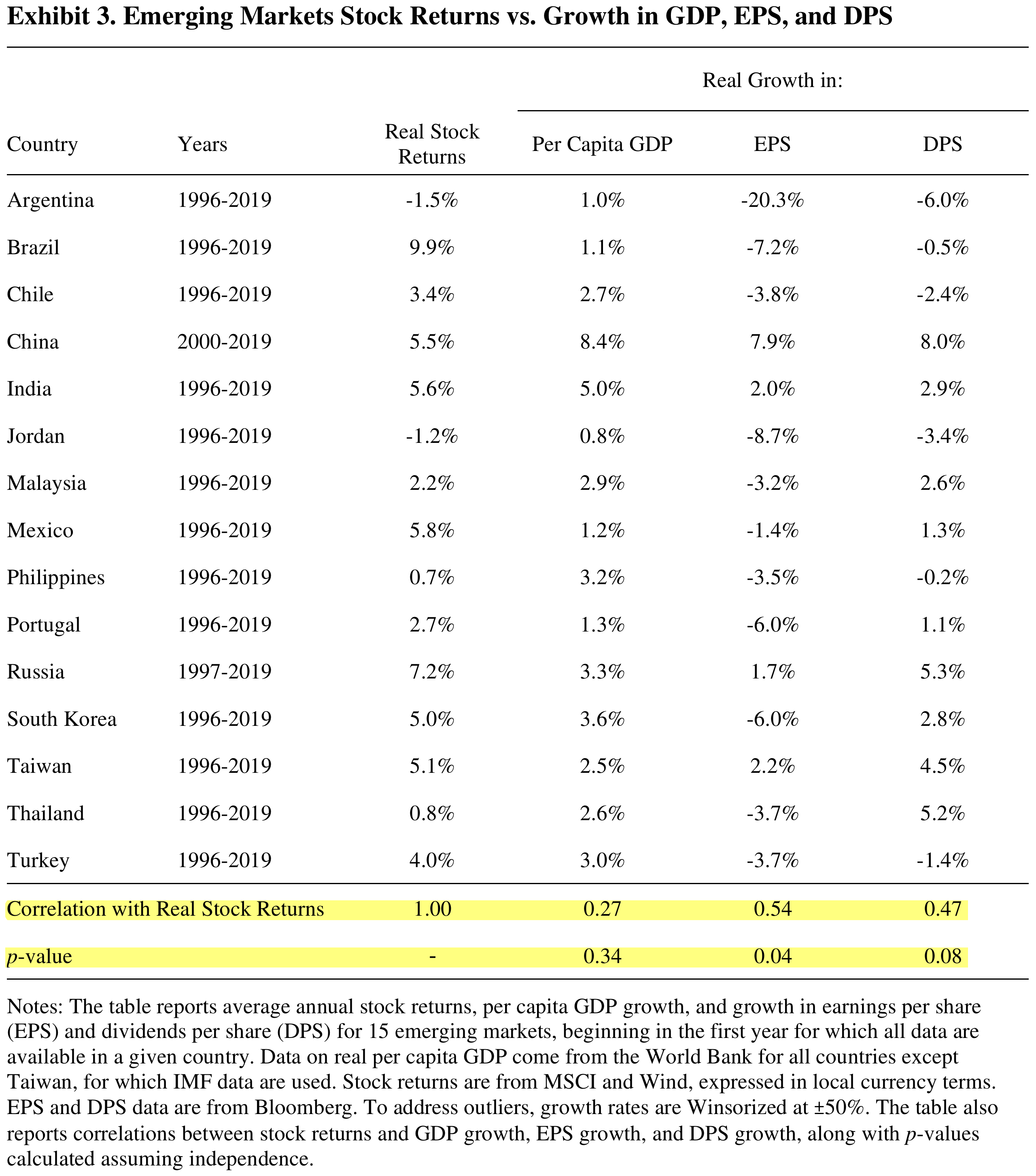

Go Where the Earnings (per Share) Are

Given the empirical results and the simple theoretical arguments above, the authors next examine the correlation between stock returns and EPS or DPS growth. As those growth rates are naturally quite volatile, they winsorize them at +/- 50% to control for the impact of outliers. I think for the aggregate stock market, those assumptions are reasonable. The following table summarizes the results.

The empirical patterns are in-line with the theory above. The correlation between GDP growth and stock returns is again statistically insignificant with a p-value of 0.34. The correlation coefficient for stock returns and EPS growth, however, is positive and statistically significant (0.54 at a p-value of 0.04). The numbers are generally similar but somewhat weaker for DPS growth (0.47 at a p-value of 0.08).

A significant positive correlation is of course no causal rule. Even when EPS outgrow other countries, you can still destroy stock returns with a decreasing multiple. Once again, this is what happened in China over the last years as investors gradually recognized that shareholders doesn’t seem to be the first priority of the Chinese economic system.

Despite that, I believe the practical takeaway is very clear. If you want to identify an outperforming stock market ex-ante, focus on EPS or DPS instead of GDP growth. This is difficult enough, so we shouldn’t waste our resources on a mythical Go Where the Growth Is argument that is empirically not existing.

Conclusions and Further Ideas

The results and ideas of the paper are, in my opinion, pretty straight forward and self-explanatory. In fact, to some the methodology may even seem too simple to believe the results. Of course, you can always do more sophisticated things and control for all kind of variables to isolate the relation between stock returns and GDP growth more comprehensively. However, I believe that wouldn’t change the overall message.

In fact, Jay Ritter, one of the authors, did the same analyses in various earlier papers (see last two boxes above) and the general pattern is remarkably consistent out-of-sample. Independent from that, Joachim Klement (see second box above) confirms the results in a similar analysis and even documents the missing relation of GDP growth and stock returns for small caps. This is some form of a robustness test as smaller companies should be more linked to the domestic economy than large caps with multinational operations.

Finally, the authors also mention an interesting point without any further analyses. While stock market returns and GDP growth are not significantly related, current stock returns do predict future GDP growth. In my opinion, this is not too surprising as equity markets are forward-looking while GDP is a historical documentation of economic activity by country officials.

The practical takeaway for investors, however, remains unchanged. Don’t Go Where the Growth Is, Go Where the Earnings (per Share) Are. But even that only works on average. There are few mechanical rules in equity markets and this is no exception.

- AgPa #82: Equity Risk Premiums and Interest Rates (2/2)

- AgPa #81: Equity Risk Premiums and Interest Rates (1/2)

- AgPa #80: Forget Factors and Keep it Simple?

- AgPa #79: The Momentum OGs – 30 Years Later

This content is for educational and informational purposes only and no substitute for professional or financial advice. The use of any information on this website is solely on your own risk and I do not take responsibility or liability for any damages that may occur. The views expressed on this website are solely my own and do not necessarily reflect the views of any organisation I am associated with. Income- or benefit-generating links are marked with a star (*). All content that is not my intellectual property is marked as such. If you own the intellectual property displayed on this website and do not agree with my use of it, please send me an e-mail and I will remedy the situation immediately. Please also read the Disclaimer.

Endnotes

| 1 | Thankfully, I adjusted my position after learning at some point that this conclusion is flawed. |

|---|---|

| 2 | The captions of the following charts provide the specific data sources for each analysis. |

| 3 | The authors stress that earnings per share instead of aggregate earnings matter for stock investors. For example, aggregate earnings could rise via IPOs even in a period of declining profitability. |